The Shoebox Service

Tax Returns, Digital Storage and Invoicing for the Self Employed

HMRC have made it law that by 2026 anyone with a self-employed income of over £10,000 will have to file under the Making Tax Digital rules.

This means that you will have to:

- File 5 tax returns a year (yep, that’s five individual returns, every year)

- Keep all of your records in a digital format (invoice books and crumpled receipts won’t be good enough)

- Use software to file all of your tax returns (you won’t be able to file directly with HMRC any longer)

Avoid HMRC misery

For the cost of a cup of coffee per week we will make sure your business stays in HMRC’s good books

83% of businesses we surveyed were not ready for Making Tax Digital

Making Tax Digital is happening - are you ready?

We have conducted extensive industry research and know that almost 3 million UK sole traders, small businesses, and self-employed people do not have a solution in place for this change in the law.

You shouldn’t have to spend a fortune on software just because you are self-employed.

And you don’t have to with Mazuma.

We can solve your problem for just £10 a month

We’re proud to offer our Shoebox service – for self-employed people who don’t have time to faff around with software. As easy as keeping a box full of receipts, you’ll also get access to our invoicing software, receipt scanning software, and an awesome accountancy team as part of the deal!

There is no need to change anything about the way you work. No need to learn to use a piece of software or have to send things in any particular format. You can quite literally send us a pile of receipts and we’ll handle the rest.

And we’ll even do your Tax Return at the end of the year as part of the service.

Ready to get ahead of the game?

What do I get in the Shoebox Service?

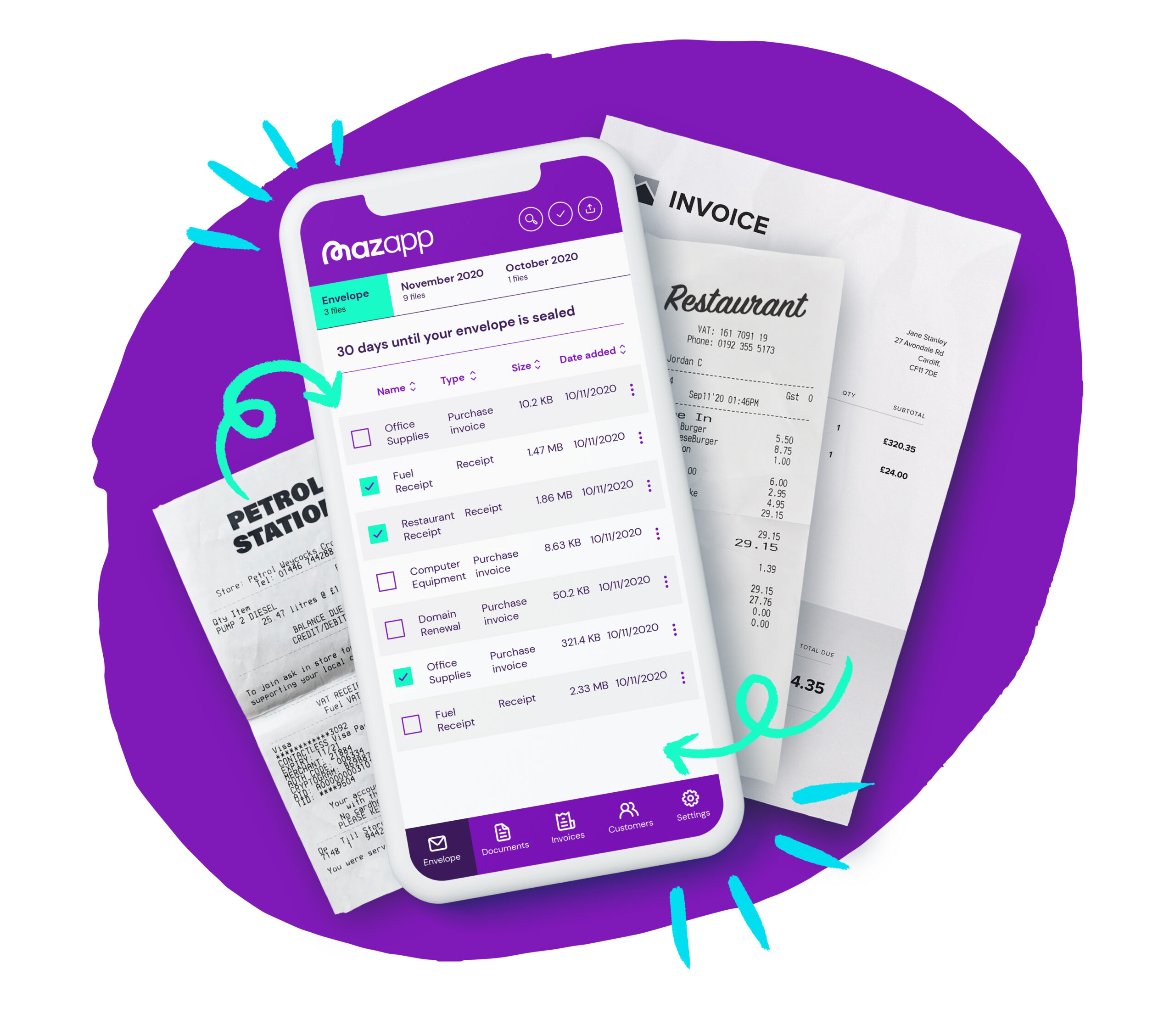

Invoicing software

Making, sending and chasing invoices can take up a significant portion of a business owner’s time and energy.

We offer automated invoicing software with our business accounting services, allowing you to send invoices at a touch of a button.

No need to buy separate invoicing software.

HMRC compliant documents

Finding an accountant who will work with physical paperwork is pretty rare nowadays. Most accountants ask their clients to use some sort of software to help them out.

But not at Mazuma.

We have developed our industry-leading software so that you don’t have to use it (unless you want to).

You can dive in digitally if you like that sort of thing, or sit back and we’ll make it happen behind the scenes without you worrying.

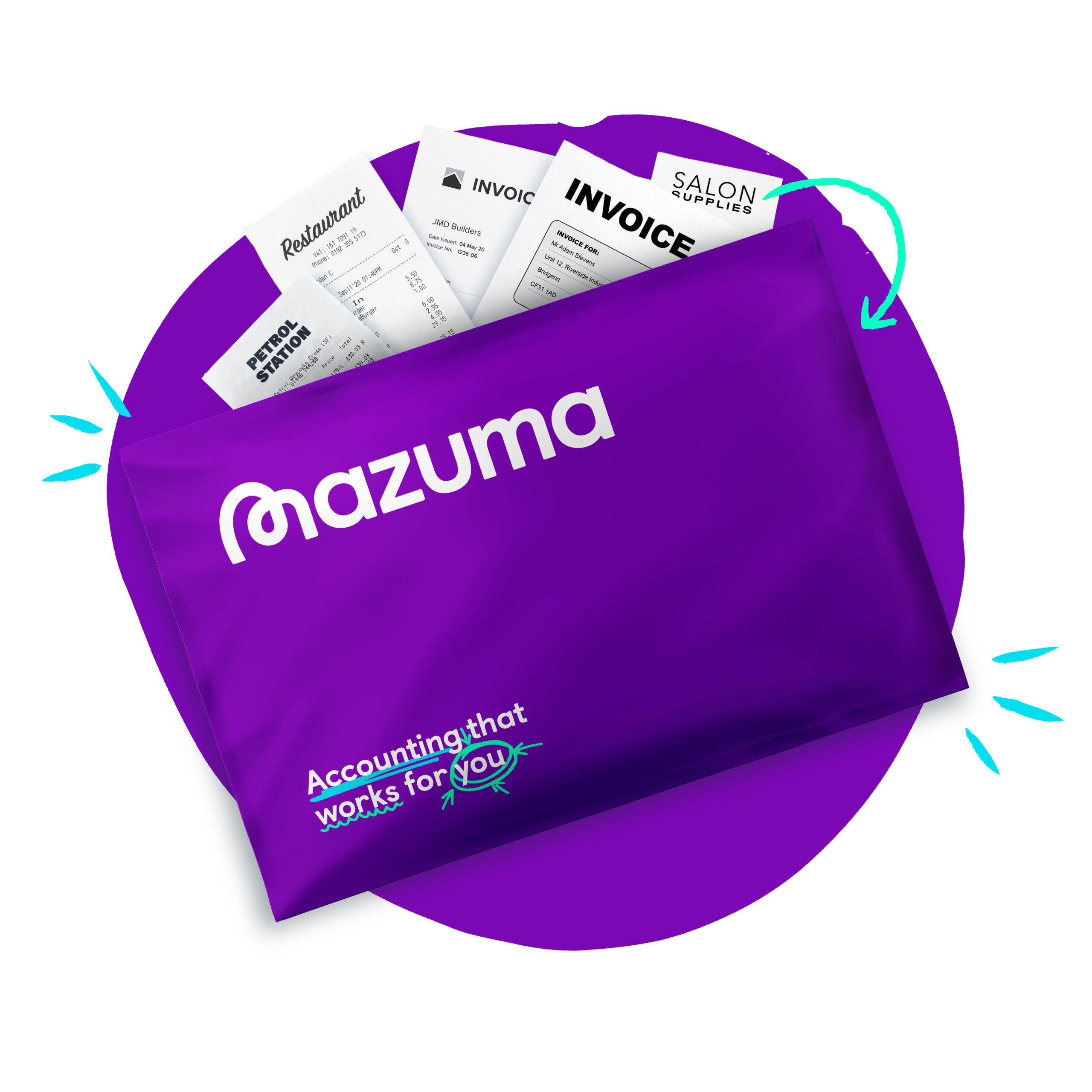

Freepost document collection

Got a pile of receipts cluttering up your life?

No problem.

Use our Freepost purple envelopes to your receipts in to us – we’ll digitise them and store them securely in our portal so you can access them whenever you need.

If the tax inspector comes knowing, our portal will have all of the documents stored in a way that will send them packing again. Nice!

This will mean that you are 100% compliant with HMRC’s new Making Tax Digital laws – guaranteed.

Dedicated Accountancy Team

Got a question? We’ve got you covered.

If you need to speak to someone during the year then we include an allowance for that within the service.

Our 100% UK-based team of accountants are highly qualified and experts in tax needs just like yours.

Pick the right package for you

Digital Shoebox - £10 a month

With our digital shoebox you get:

- Self-assessment tax return

- Invoicing software

- Receipt scanning software

- Access to your digital documents from any device, anywhere

- 100% HMRC compliant document storage

- Dedicated UK-based accountancy team

- Peace of mind as the TaxMan is off your back!

Freepost Shoebox - £12 a month

With our Freepost shoebox you get:

- Self-assessment tax return

- Invoicing software

- 4 x Freepost envelope per year to send us your paperwork

- Receipt scanning software

- Access to your digital documents from any device, anywhere

- 100% HMRC compliant document storage

- Dedicated UK-based accountancy team

- Peace of mind as the TaxMan is off your back!

I spent an hour a day numbering receipts!

“When my husband went out on his own as self-employed we used an accountant up the road from us because it seemed the easiest thing to do. That was a huge mistake! He used to make us number the all of the receipts and invoices ourselves (which meant that I was the one who did it), and then he charged us a fortune at the end of the year to get a tax form that we didn’t understand.

I literally haven’t looked back since I switched over to Mazuma. What a lifesaver!”

Sarah B, Manchester

Don't believe the Xero hype

“My last accountant only used Xero and used to absolutely rave about it. So when I joined him he got me signed up with Xero and it just didn’t occur to me to question it.

Fast forward a year and I have barely logged on and my accountant is nagging me on the phone that my tax will be late if I don’t put everything in Xero – but I thought he’d be doing that!

Anyway, I found Mazuma through a friend and at first I thought it was too good to be true. But honestly, it’s not!

I’m sure Xero is great if you love that sort of thing, but it was too much for me and my tiny business. Mazuma all the way now!”

Dean R, Newport

What our clients say...

Get HMRC compliant now

FAQs

Why is this service so cheap?

We user a killer combination of technology and people. We use technology to do the grunt work and then our qualified and chartered Accountants to do the technical stuff. That way, we can keep our prices rock bottom.

Do I really get an accountancy team for £10 a month?

Yep! When you get a scary letter from HMRC, or have a quick question about tax, your accountancy team will be there to help you out. Of course, for £10 a month we don’t expect you to be on the phone to them for an hour a day (even though they’re all very lovely!), so if you want a bit more support them you can upgrade to one of our other packages.

Are my year-end tax returns included?

Yes! A basic tax return is included in the price. To keep things simple we’ll ask you to fill out a form at the end of the year so that we can collect all of your data. If you want us to complete the bookkeeping and accounts for you, you can upgrade to one of our more comprehensive packages.

Will this make me compliant with the new Making Tax Digital rules?

Absolutely. That’s the whole point of this service. We’ll get you compliant with the new laws without you having to change the way you work or invest time and money into buying and learning a software package (which usually starts at around £34/month).