Low cost, no hassle, online accountancy services

Born to lighten the load.

Monthly accounting subscription service for as little as £38 + Vat per month

You didn’t start your business just to drown in paperwork. You were born to run the show. So leave the accounting to us and get back to a balanced life (not a balance sheet).

We’re experienced, dedicated – but most importantly, we get it. Our stress-free accounting services were built just for start-ups, sole traders, freelancers & small businesses.

From accounts to bookkeeping; tax to payroll – we’ll handle the lot. All for less than the cost of that gym membership you absolutely, definitely use.

Call 02921 051 962 to speak to an actual real-life human, or get your quick quote below.

Born to cut through your chaos

Whether you’re looking for a few specific accounting services, or need the full monty monthly subscription, our team will keep your books tight and your business compliant – without draining your hard-earned cash.

So you can get back to what it is you do best: running your business like the boss you absolutely are.

Your Monthly Accounting Services Subscription will include

Managed Bookkeeping Service

Bookkeeping is tedious for any business owner, and falling behind is easy to do. Avoid hours of playing catch-up with our managed bookkeeping service. Our accountants will run this essential aspect of your business, saving you time and allowing you to focus on the things that matter most to you.

Invoicing software

Making, sending and chasing invoices can take up a significant portion of a business owner’s time and energy. We offer automated invoicing software with our business accounting services, allowing you to send invoices at a touch of a button.

Management Accounts

Most small business owners are passionate about their product or service – not managing their accounts. Focus on the stuff you enjoy and leave the complex work of managing taxes and accounts to us. Our experts will keep on top of this challenging aspect of running a business, so you don’t have to.

We’ll prepare your monthly Profit & Loss Account, Balance sheet and detailed Ledger Listings. Your qualified Accountant will give you tailored advice and tax estimations.

*Available on selected packages

Statutory year end accounts

Need help with your year-end accounts? When you sign up to our subscription package, we’ll ensure you save time, submitting your year-end accounts to HMRC and Companies House on your behalf. If you’re a limited company, you’re legally required to submit these accounts – failing to do so may result in hefty fines. And with Making Tax Digital rules coming into place in 2023, it’s even more important that you undertake accurate digital record keeping. With our support, you can stay compliant with the law.

Self assessment tax return

Managing your finances as a self-employed individual can be challenging enough without adding self-assessment tax returns to the mix. You may find filing for a tax return too complex, or you may not want to commit the time and energy to the job. The team at Mazuma can handle your self-assessment accounts and tax obligations for you, ensuring you will avoid fines for error or delays.

*Available on selected packages

VAT Return Service

Calculating and reporting VAT is a complex, time-consuming process. Our accountants will sort your VAT returns for you. From checking you’re on the right scheme to ensuring that everything is accounted for correctly, our team will handle it all. With Mazuma, you can guarantee that your returns are submitted on time.

Corporation tax return

All businesses in the UK are required to file HMRC tax returns on a once-yearly basis. This can prove particularly overwhelming if you don’t keep on top of your tax affairs on a month-by-month basis. We’ll help your businesses to be more tax-efficient with our digital corporation tax return service.

Payroll Services

For a small additional fee we can take care of your payroll too.

Keeping track of payroll is essential – and nothing upsets employees more than an error or delay with payslips. To make sure your employees are paid on time, and that national insurance and pension contributions are made accurately, use our outsourced payroll service. We’ll tell you who and what to pay, provide the payslips, and file your reports with HMRC. We cover all company payroll activities, offering the most comprehensive solution.

Your quote, quicker than making toast

As a small business owner, contractor or freelancer, your time isn’t just money. Every second’s sacred. So we’ve made setting up your business accountancy a total breeeeze.

Now, you can outsource the tedious accountancy tasks to us, and fill your hours with the things that mean the most to you. Like knitting tiny sweaters for your cat. Or organising your Tupperware drawer.

Fill in our quick quote form for a no-obligation quote.

(Bet you can do it before the toast pops up.)

Who we help

From ‘solo acts’ to the ‘here’s the whole pack’s. We’re a national company, providing our tailored online accounting services to all kinds of businesses across the UK.

You can find a few of them below.

Unsure if we can help? Give us a call. Promise we won’t bite (we can’t reach through the phone).

Startups

As a business startup, you’ve already got a lot on your plate. Our business accounting and bookkeeping services can simplify your processes from day one. We’re here to provide a tailored money management solution that will help you achieve your business goals, pronto.

Small Businesses

We get it. No two small businesses are the same. So guess what? The service we offer is anything but “one size fits all.” Our small business accounting services are for growing businesses and tailored to suit your specific industry, current situation, and future goals.

Sole Traders

As a self-employed tradesperson, you know the struggle of juggling client invoices and mountains of receipts for things you’ve purchased. Builder, plumber, gardener, designer, hairdresser–whatever your craft, our solid accounting keeps your books tight and your business compliant. Without draining your hard-earned cash.

Ltd Companies

Goodbye number-crunching headaches. Hello smoooth growth. When you’re running a limited company, tracking assets, income, debts and spending can eat up your time. And sanity. Our no-nonsense money management solutions free you from responsibility overload, so you can get back to what really matters.

Freelancers

As a freelancer, you’re already responsible for keeping so many balls in the air. Our self-employed accounting services are built just for you. We take the hassle out of managing your finances, so you can concentrate on securing work and growing your business.

No unwanted surprises. No mistakes No staying awake worrying about numbers.

Micro Businesses and Solopreneurs

Just because you’re a small operation, doesn’t mean you should settle for small-time service. Microbusiness is a specialist area, so finding an accountant with expertise and experience working within this type of business structure is pretty important. That’s where we come in. Our specialists will take care of your accounts and tax obligations so you never fall behind.

Here’s how our Accounting service works.

No fuss. No fluff. No faff.

We’ve designed our business accounting service to be as simple and hassle-free for you as possible. We understand what when you’re outsourcing your accounting to a professional; you want to feel confident that your accountant will deal with every aspect of the job themselves.

Simple Invoicing Software.

Invoice Smarter. Stress less.

Create and track invoices with a few taps.

When you’ve finished a job, use our MazApp software to send a professional invoice instantly from your desktop or mobile device.

With our simple, customisable invoicing tool, you can:

- Send invoices from any device

- Easily add customers

- Send reminders to late payers

- Create statements

- Keep track of money owed

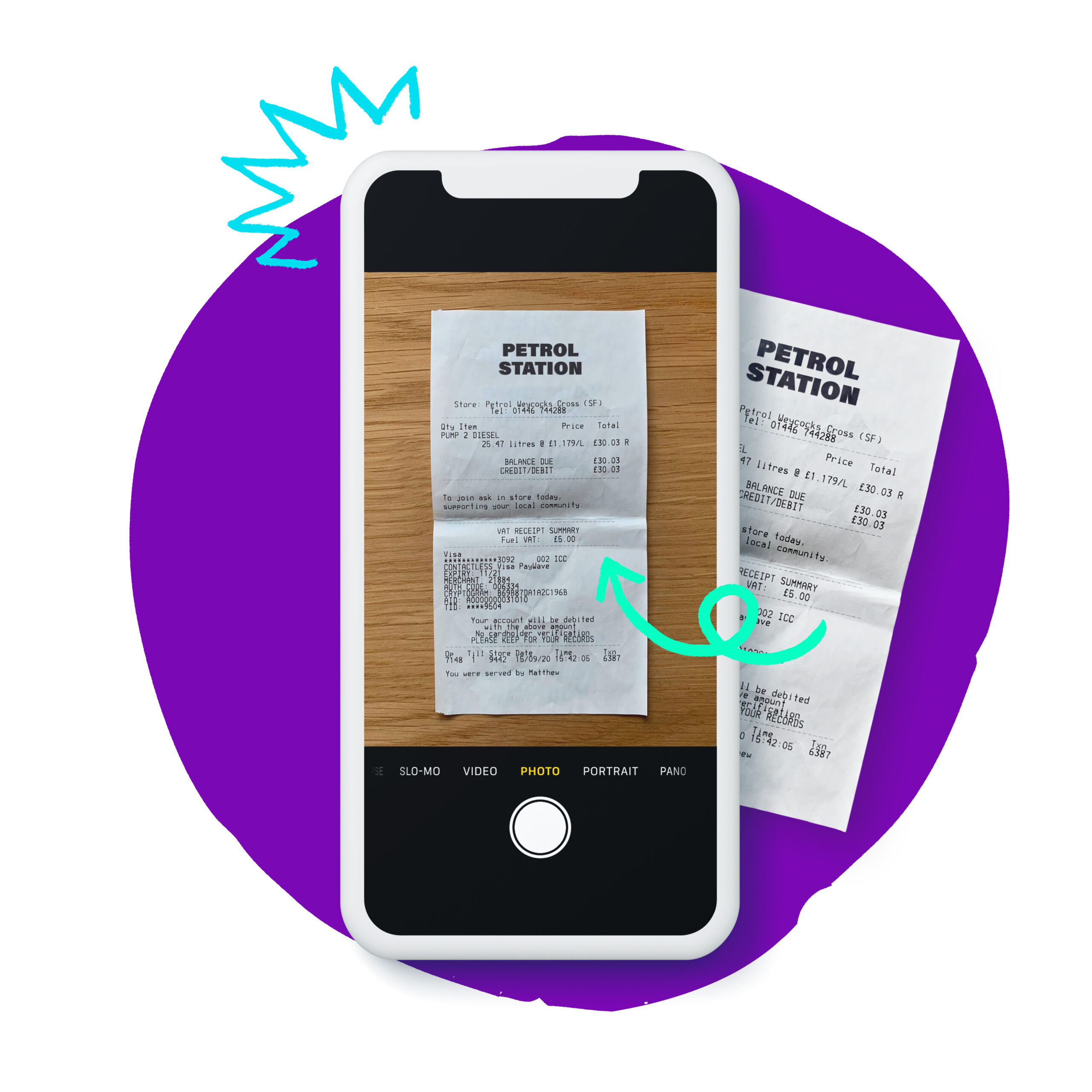

Choose how you submit your paperwork

Online

Via our web portal (MazApp)

Our secure web portal makes sending us your documents easy as. Upload, share and access everything you need, when you need it from any smartphone, tablet or desktop.

Raise invoices, follow up on payments and tracked what you’re owed – all in one place.

By Post

Using Royal Mail Freepost

A lot of businesses and sole traders still live in a world overflowing with bits of paper. Pockets stuffed with receipts and in-trays overflowing with letters. Sorting through all of that? No thanks.

Unlike many accountants who make their clients enter data or scan and upload endless paperwork, we keep things simple.

Just pop your documents into one of our pretty purple envelopes and send it to us.

We’ll do all the boring admin. And you can access your reports through MazApp whenever you need to.

Mazuma Business Accounting Services

At Mazuma, we understand that freelancers and small business owners are driven by a passion for the job they do. It’s rare for a sole trader or business director to feel excited about annual accounts management or taxes, but these tasks are an unavoidable aspect of working for yourself.

Our team of chartered accountants supports our clients with the arduous and often overwhelming factors of running their own business. Our accounting and bookkeeping services can be tailored to all business models, types and industries.

If you’re a contractor, a growing small business, or a start-up, you can significantly benefit from our subscription accountancy solutions, problem-solving, and practical advice.

We’ll take care of Companies House and HMRC for you. Using our simple online accounting software, we can help with everything from tax planning to simplifying invoicing. We can also prepare reports and calculate VAT on your behalf. We’ll assess your business needs and figure out exactly what would suit you best.

Whatever your business type, if you’re looking for a quality service, you’ll find it with Mazuma. Our chartered accountants offer the perfect combination of services to help you to save money and build a viable business, whatever that looks like for you.

FAQs

What are the accounting services that you offer?

Our team offers a broad spectrum of accounting services and support, including payroll services, VAT return, managed bookkeeping, accounts management, tax return, and invoicing.

Is there a minimum contract period?

No. There is no minimum contract period or ‘tie-in.’ You simply pay a fixed monthly fee, and you have no obligation to sign up to our business accounting service for a set amount of time.

What happens if I don’t declare all my income?

If you don’t accurately declare your income, you will likely be fined by HM Revenue. This is why we recommend choosing an accounting firm that offers a quality service, such as Mazuma, to support you in managing your finances – especially if you’re a new company or freelancer.

Am I entitled to a refund for previous months if I leave Mazuma mid-way through the year?

No. If you leave Mazuma part-way through the year and have not yet come to your company year-end, we can’t refund you what you have paid during the months that we have advised you and acted on your behalf. We will not offer any refunds for any work that has already been carried out and returned to you.

What happens if I sign up for your business accounting service part-way through the financial year?

If you sign up with us part-way through your financial year, our accountants will likely have to play catch-up with your bookkeeping and accounts to get them up to date.

For example, if your financial year commences in April and you sign up with Mazuma in July, your first payment will be 4 x £ monthly to cover April, May, June, and July. Don’t worry – you can split your catch-up payment over the first three months of your contract if you prefer.

Once you’re up to date, you will only need to pay a fixed monthly price for our support. For us to complete your year-end accounts and tax returns, we simply ask that you have been a client of Mazuma for one year or have made the equivalent of 12 monthly payments.

Will I get assigned an accountancy team?

Of course! You will be allocated an accountancy and tax advisory team when you choose our business accountancy services. This team will always deal with your accounts and tax and will be available to answer any ongoing questions you may have.

How much responsibility will you take on?

All of it! We speak to HMRC on our clients’ behalf and submit all their digital returns. If we receive any vital information you need to know, you can rely on us to keep you updated.

Are my year-end accounts included in the monthly price?

Yes. The fixed monthly price includes all your year-end statutory requirements and tax returns, as well as your monthly bookkeeping, management accounts, payroll, VAT and other services you have selected in your instant quote. This will all be outlined in the terms and conditions you will receive when your company signs up with Mazuma.

What are the details you’ll need from me?

When you partner with us, our chartered accountants will require the following details from you:

- Your full name and ID (either drivers’ license or passport)

- Your D.O.B

- Your current address and proof that you live there

- Your mobile and/or home phone number

- Your NI (National Insurance) number

- Your company name and number

- Your UTR (Unique Tax Reference) number

- Your VAT registration number

- Documentation of your previous tax return

Some of these details may not apply to you, and that’s fine. We will let you know what we need when we contact you.

Is it challenging to switch accountants?

Not at all. If you’re switching from an old accountant, we’ll handle the process for you. Usually, this will involve writing to your previous accountants to arrange for your documentation to be transferred over to us online. We will then send you an engagement letter, and you’ll be required to confirm that you’re happy for us to act for you in certain areas.

How do I get started?

If you’re keen to hand your accounting responsibilities to us, simply fill in your details here to get an instant quote online. If you’re happy to proceed, we can then arrange a free consultation to discuss your requirements with one of our expert accountants. We’ll provide you with all the information you need to know before getting started.

Born to cut through your chaos

With our expert team of Accountants taking care of your data, you can focus on what you do best and get back to what matters. A balanced life, not a balance sheet.

No unwanted surprises. No mistakes. Just peace of mind knowing that if HMRC ever come knocking, you haven’t mistakenly claimed an unapproved expense or forgotten to declare income in your tax return.

You were born for business. And Mazuma was born to keep it that way.

Thousands of Happy Customers

Mazuma are considered the best Accountants, and MazApp the best receipt filing, scanning, and invoicing tool by thousands of customers across the UK. We’ve simplified bookkeeping and accounts for thousands of small businesses, offering a quick and easy way to convert every receipt into a digital version.

Customers love us because we offer a simple online space for adding, tracking, and storing data. Find out what you’re missing out on and sign up to our receipt scanning app today.

Expert help

Not all receipt scanning apps will pair you with a member of your accountancy team. When you sign up to Mazuma, you can rest assured that your bookkeeping is being taken care of by one of our highly qualified accounting experts.

No last-minute rush to file your taxes – we’ll keep on top of your finances in the run-up to tax season, saving you hours of hassle. All you have to do is send us your receipts.

Time to change accountants?

Just need a quick one-off service?

If you need your basic compliance done without the advice and support of an Accountant throughout the year, our one-off packages are for you.

One Off Accountancy Packages

Sole trader accounts and tax return

Left your end-of-year accounts and tax return to the last minute (again)? Don’t worry, our team of qualified accounts can sort it out for you quickly, and for only £350.

HMRC tax return service

Hate messing around on the HMRC website trying to submit your tax return? Always put it off until the last minute as there is always something better to do?

Ltd company dormant accounts

Mazuma can file your Dormant Company Accounts for only £100. Avoid penalties and let us take care of it for you.

Limited company accounts

Need a set of Ltd Company Accounts done but don’t need year-round support? Our one-off Ltd Company Accounts service could be perfect for you and costs from just £575.