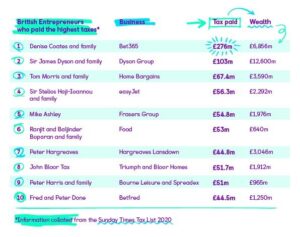

Britain’s entrepreneurs who paid the highest taxes in 2019

The Sunday Times Tax List 2020 was released earlier this year outlining those who are paying the highest taxes in the UK. But of that list, how many of them are entrepreneurs? If you want to know the answer, you’ve come to the right place!

As a whole, the list is compiled of investors, self-made entrepreneurs, noblemen and women, media giants and other creatives, as well as those who have inherited wealth from family. It’s a real mixed bunch! Having sifted through the list, we’ve compiled the data and created a new list – Britain’s entrepreneurs who paid the highest taxes in 2019! Keep reading to see who made the cut into the top 10…

Britain’s entrepreneurs who paid the highest taxes in 2019

1. Denise Coates and family / Bet365

At the top of the list, Denise Coates and family’s tax liability was £276m on a wealth of £6,856m. Coates’s bill appears to be driven by her willingness to stay in the UK and by running her own salary of £276.6m through PAYE, making it liable for nearly £130m of income tax and NI. The family’s share of the business’s corporation and payroll taxes adds up to £113.2m.

2. Sir James Dyson and family / Dyson Group

It’s well-known that Sir James Dyson is about to move his business empire to Singapore. Dyson paid £103m tax on a wealth of £12,600m, although his move is likely to cost the UK in future tax income.

3. Tom Morris and family / Home Bargains

Tom Morris is founder of the Home Bargains discount chain; he and family paid £48.9m of corporation tax in 2018-19, plus a further £14.2m of other business taxes. A genuine family business, Morris’s brother is COO and three more of his six brothers are also understood to work for the business. They took a £10m dividend incurring £3.8m of tax, and the ST report also includes almost £450,000 tax on salaries.

4. Sir Stelios Haji-Ioannou and family / EasyJet

The airline carrier is still 33.73% owned by larger-than-life figure Stelios and his family. Despite the recent woes of the aviation business, it paid £72m corporation tax and £95m social security costs in 2018-19; some £56.3m of this likely to be paid directly by Haji-Ioannou and family, according to the Sunday Times report.

5. Mike Ashley / Frasers Group

Mike Ashley used to be a sports coach, and he’s used that disciplined and competitive nature to buy up high street businesses that he sees as needing a pep talk. He owns 61% of Sports Direct, renamed Frasers Group. The report allocated £54.8m of £89.8m of corporation and payroll taxes to Ashley personally.

6. Ranjit and Baljinder Boparan and family

The Boparans now own the Bernard Matthews business, where business is bootiful as one in three poultry products eaten in the UK is supplied by them. They took no dividends after difficulties with the restaurant side of the business, but the two interests combined had a net contribution of £5m corporation tax and £48m of payroll taxes.

7. John Bloor / Triumph and Bloor Homes

John Bloor helped make Triumph motorbikes a roaring success after establishing his own construction business in the late 1960s. Last year Bloor was liable for £48.4m of UK business taxes and the Sunday Times also calculates his £8.7m dividend as incurring £3.3m of tax.

8. Peter Harris and family / Bourne Leisure and Spreadex

Peter Harris and family own 42.9% of Bourne Leisure, which runs Warner Leisure Hotels and Haven Holidays. They also own 71.8% of Spreadex.com, making them the second of three betting business owners on the list. Tax liabilities include £48.2m of corporation and payroll taxes for Bourne.

9. Peter Hargreaves / Hargreaves Lansdown

At number 9 on the list, finance professional Hargreaves has a huge wealth of £3,046m but manages to keep his tax bill down to £44.8m. Hargreaves paid £21.5m of the firm’s £66.7m corporation tax and payroll taxes (he owns 32.16%). Tax on nearly £61.3m of dividends in the same year adds £23.3m to this.

10. Fred and Peter Done / Betfred

You’d get good odds on finding another gambling operator on the list, and the top ten is rounded off by Fred and Peter Done: founders of Betfred. Fred’s the bookie, and Peter’s the legal and insurance mind. Their combined tax liabilities in 2018-19 were £23m and on their £56.6m of dividends they paid £21.5m tax.

NOTE TO EDITORS

Mazuma is the UK’s leading accountancy firm for small and micro businesses, providing hassle-free, online accounting to businesses across the UK. Using a combination of cutting edge technology and the expertise and experience of chartered accountants, we create an accounting service that can truly make a difference.

Mazuma won the Account and Tax Adviser of the Year award at the British Business Awards 2019 and the British Small Business Awards 2018, and has recently partnered with the Great British Entrepreneur Awards, having been awarded Disruptor of the Year at the awards in 2019. Lucy Cohen, Co-Founder of Mazuma, will also be judging the event alongside other prestigious entrepreneurs.

Lucy won Accounting Personality of the Year in 2009 and was a finalist in the Institute of Directors Awards 2019 after being named Wales Director of the Year in the innovation category. She is on the Advisory Board for AccountingWEB Live which will be held in the RICOH Arena, Coventry, on 2nd and 3rd of December.