The end of the Annual Tax Return

What is Make Tax Digital?

HMRC has outlined it’s plans for MTD for income tax self-assessment, and the changes mean that four million taxpayers will need to submit quarterly returns to HMRC instead of just one annual tax return. They’ll also need to produce end of period reports for each trade and property business.

This means that a non-VAT registered sole trader will need to undertake multiple submissions for different periods under MTD for income tax.

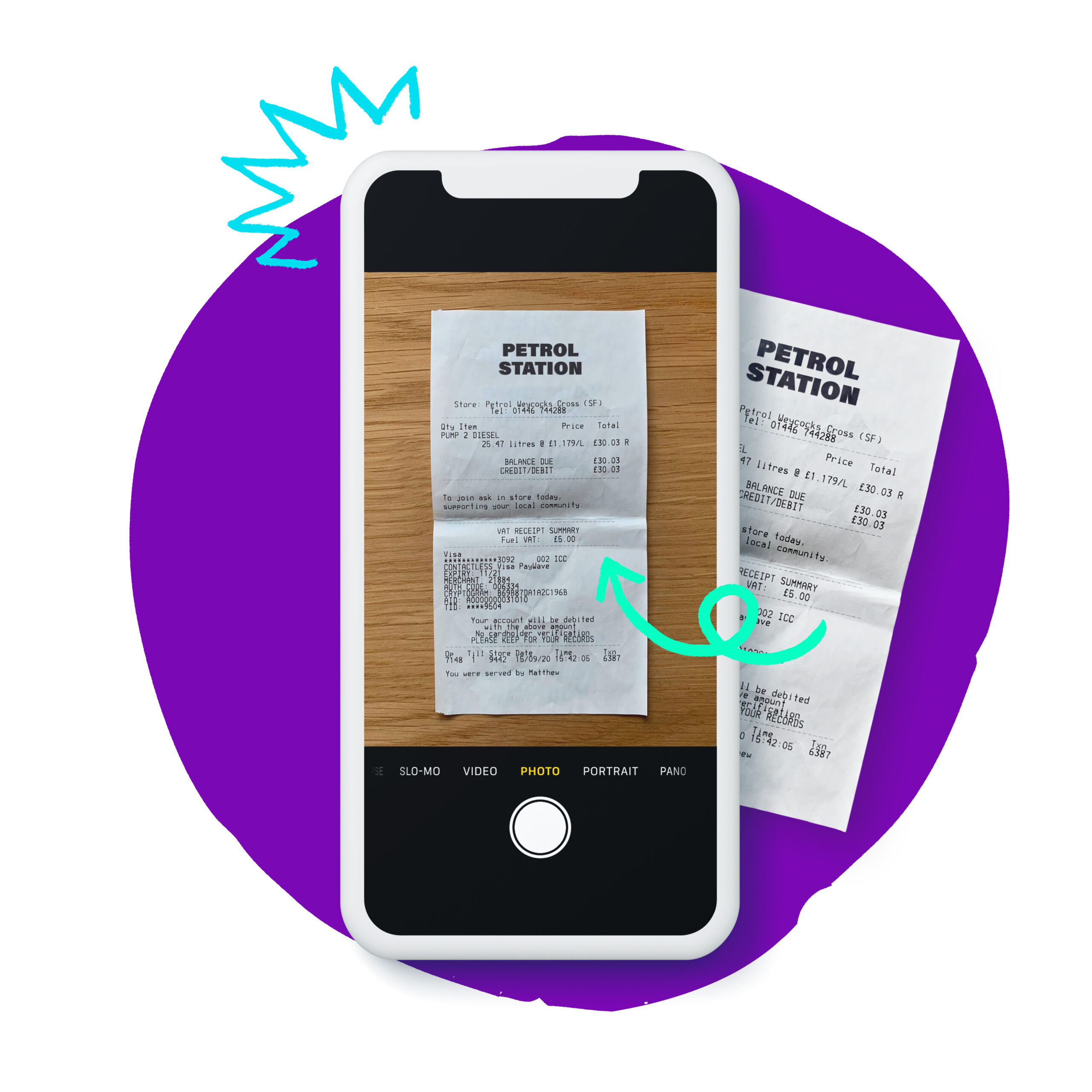

These businesses will also have to undertake digital record keeping in line with MTD rules.

Learn how to get ready for MTD

What reports are required?

For each trading or property business that you operate, you’ll have to submit a quarterly report of income and expenses in defined categories. Essentially, this will be a mini set of accounts each quarter.

But it doesn’t stop there. You will also have to submit an end of period statement (EOPS) for each of those businesses. Yep – that’s five reports to HMRC every single year.

The quarterly reports will be due exactly one month from the end of each of the quarter, which gives you less time than the one month and seven days after the end of the quarter for VAT which is currently used for MTD for VAT.

The EPOS and the finalisation statement are both due by 31 January after the tax year end.

All our packages are MTD compliant

When does this start?

From 2026 any self-employed business, sole trader or landlord with income of over £50,000 will have to file under the Making Tax Digital Rules. Those with income over £30,000 will be mandated from April 2027 and the remaining small businesses’ timescales to be reviewed in the future.

MTD for Income Tax is a lot of work for Small Businesses

MTD sees the biggest change to the tax filing regime in a generation. We don’t think that you should have to handle it on your own.

So all of our packages include full MTD compliance.