What’s the Making Tax Digital verdict?

MTD explained

By now, a lot of businesses will have adopted the digital approach of submitting their VAT to HMRC. If you haven’t made the switch to digital bookkeeping yet, please do not panic! We’re here to help you break it down.

In summary…

Making Tax Digital (MTD) means that it is now – or very soon will be – compulsory to use a digital bookkeeping system for submitting tax to HMRC.

The idea is that you choose a digital, cloud-based, software for your bookkeeping which, in turn, allows you to submit your tax return at the click of a button.

Alternatively, you use an agent who uses MTD-compliant software with access to your accounts so that everyone is using the same system, has the same information and is essentially singing from the same hymn sheet.

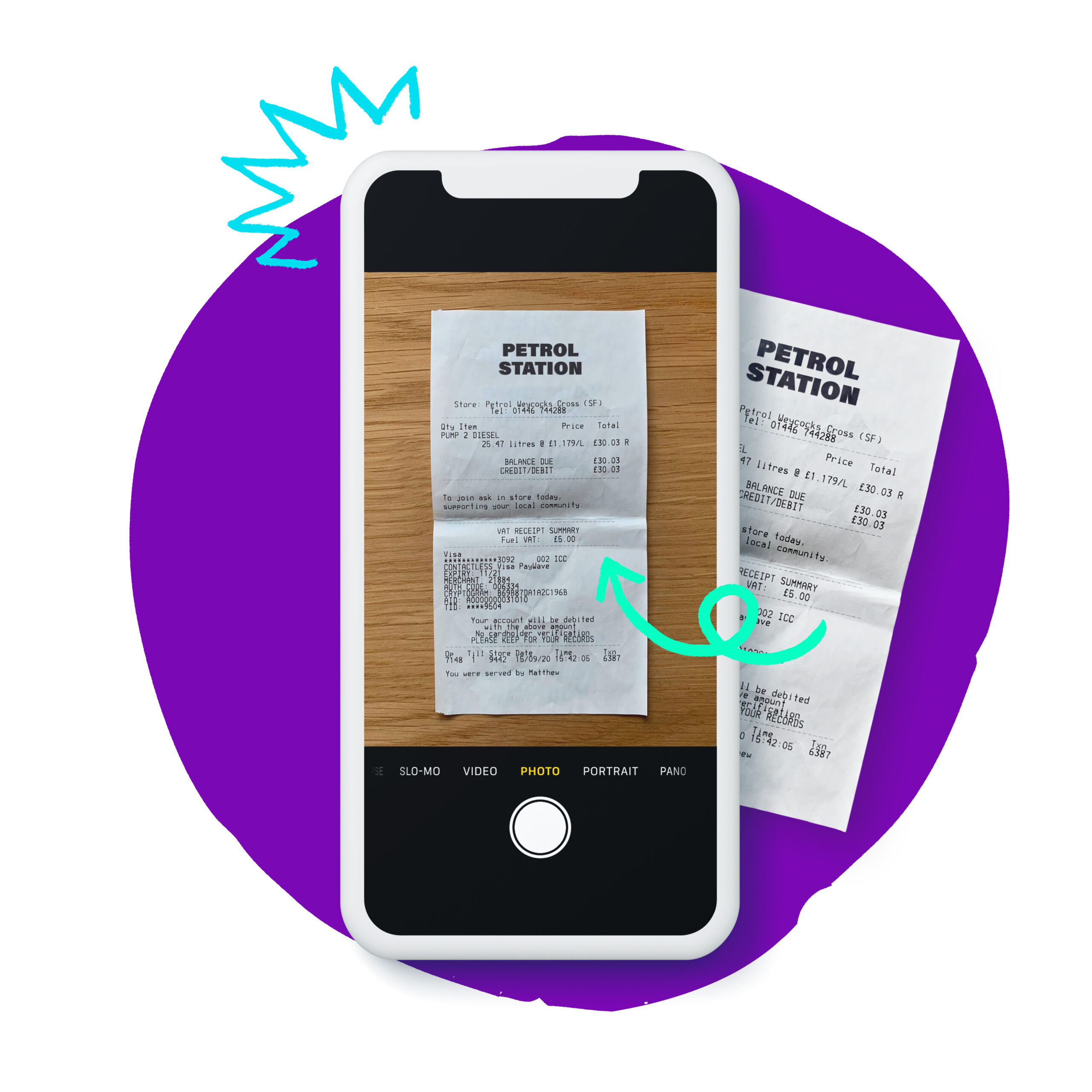

Some snazzy accountants, including Mazuma, even have their own app that helps you keep on top of your books and paperwork in real time, which makes the entire digital process much easier.

The updated deadline for Making Tax Digital

Because the UK government has been a little preoccupied with Coronavirus and Brexit, HMRC won’t be enforcing MTD for any new taxes or businesses right now. This means that it’s likely April 2024 will be the earliest start date for income tax returns to be compliant with MTD. That’s good news because it gives everyone a little bit more time to get on board.

That said, it’s really worth setting yourself up ahead of the deadline. And here’s why…

Why Making Tax Digital is better for everyone

Efficiency

Feeling protective over your current bookkeeping system is understandable, especially if you’ve been using it for years. It might be scary to think about switching over to a new system and feel like you’re starting all over again when you’re so efficient with the current system. This is where an accountant or bookkeeper can prove extremely useful.

When it comes to Making Tax Digital, using an online accountant is ideal. You won’t have to worry about compliance, because they’ll handle it all for you. When it comes to submitting your taxes quarterly, which is likely to happen – using a reliable accountant will give you peace of mind and ensure that your business is compliant and won’t face any fines.

Ease of use

Whichever software you end up choosing, you can be reassured that it has been tried, tested and tweaked to make for the best user experience. Cloud-based bookkeeping is literally designed to be logical, simple and (dare we say?!) enjoyable to use.

Most (if not all) will have a swish looking dashboard that displays a quick overview of what’s going on at any given moment; the ins and outs, bank balance, outstanding payments and so on. Of course, if this is something you don’t want to spend your time on, you can always use an accountant to sort this for you.

Accuracy

The digital systems required by Making Tax Digital ensure everything is calculated electronically, avoiding human error. As long as you log everything as and when it happens, you can sit back and relax while the software works its magic. Everything is accounted for using one system .

By avoiding mistakes, in theory, this should also mean fewer dealings with anything tricky from the folks at HMRC.

Making Tax Digital is happening, and there’s no way around it!

Whether you opt to do it yourself with a HMRC-approved software, or by outsourcing your accounts to a reliable accounting company, Making Tax Digital provides an opportunity to simplify your finances, and regain some clarity and control of your accounts.

Frequently Asked Questions

- You can reclaim any VAT that you're charged for when you pay for goods or services. The VAT you pay could end up being more than the VAT you collect from your customers, which means you can receive the difference back from HMRC, thereby saving you some money.

- If you have many business customers, they can claim back the VAT you charge (providing they're also VAT registered), saving them money and ensuring you look more attractive than a non VAT registered firm.

- If you know your business is growing rapidly and you're nearing the threshold, it can be worthwhile registering early rather than later. That way, you're prepared for changes and you can adapt on your terms.

- It also looks good in the eyes of other businesses and clients. You look like a serious contender within your field. And potentially one that has a much higher turnover than you do in reality.