What is HMRC’s plan for Making Tax Digital?

HMRC has said that it won’t widen the scope of Making Tax Digital for business beyond VAT-registered businesses before the system has been shown to work successfully. In an announcement in July 2020, they have said that it won’t be until 2024 that almost everyone will be required to file in line with MTD.

This time frame will ensure that there is time to test the system fully and for digital record keeping to become more widespread.

Let us take care of MTD for you

What will businesses need to do for Making Tax Digital when the scope widens?

Digital Record Keeping

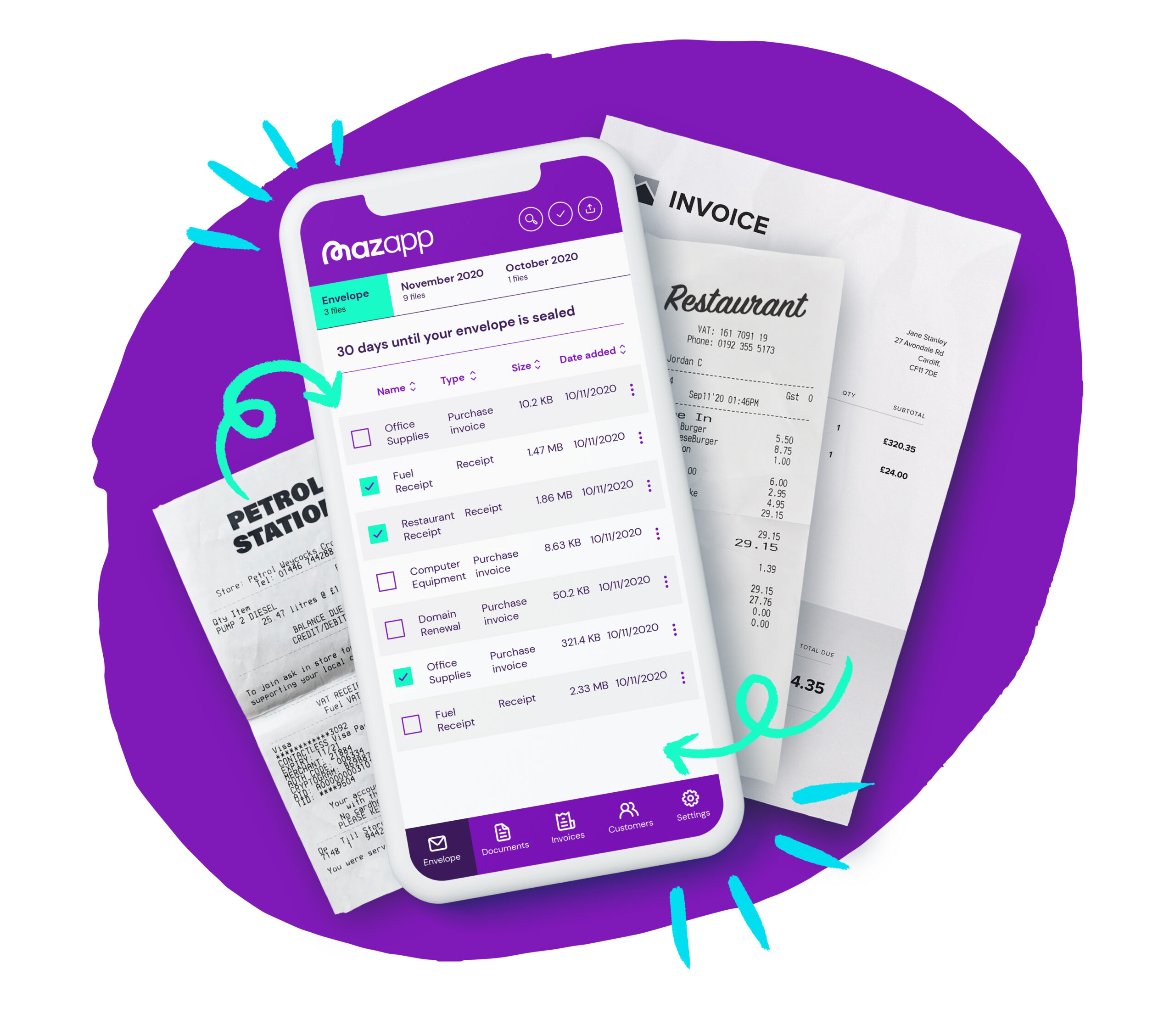

The first main requirement for businesses for MTD is to maintain records digitally using third party software. This is something you may already do, so may not actually have much of an impact on how you currently keep track of your records. For those not already keeping digital records, it would be wise to start that process now and become comfortable with it before it becomes mandatory.

Quarterly updates and a tax estimate in year

Business owners will need to update HMRC on a quarterly basis using their digital records – a significant shift in current obligations. Many businesses already keep on top of their record keeping and accounts in order to keep themselves accountable and keep track of their finances. However, if you don’t already provide regular updates, it may be an extra burden on your shoulders. Despite the extra hassle, it will give greater certainty about your tax liability throughout the year.

Paying tax more frequently

Although it hasn’t been confirmed by HMRC or government, MTD could give businesses the opportunity to pay tax more frequently, closer to real-time and potentially on a voluntary basis. This is different to how businesses currently pay their tax bill – once per year after the end of its financial year. Given that it was introduced with Real Time Information in payroll back in 2013, it’s our prediction that it will also be introduced as part of MTD.