What does ‘keeping digital records’ mean?

Digital recordkeeping explained

Keeping digital records is a core aspect of Making Tax Digital. From now on you will need to keep your records in a digital format, stored on a computer or in the cloud.

MTD’s process means businesses will no longer be able to use things like a ledger book or duplicate pad as their primary source of data storage. Likewise, a till that physically prints out a till report at the end of the day but doesn’t store that information anywhere will need to be replaced with something that does.

If you produce handwritten invoices or receipts then you will have to transfer the accounting information to your MTD compliant software before you submit your VAT Return (or get your accountant to do it for you!). That can be quite the headache and take up a lot of your valuable time, which is why it’s often better to pass it over to your accountants.

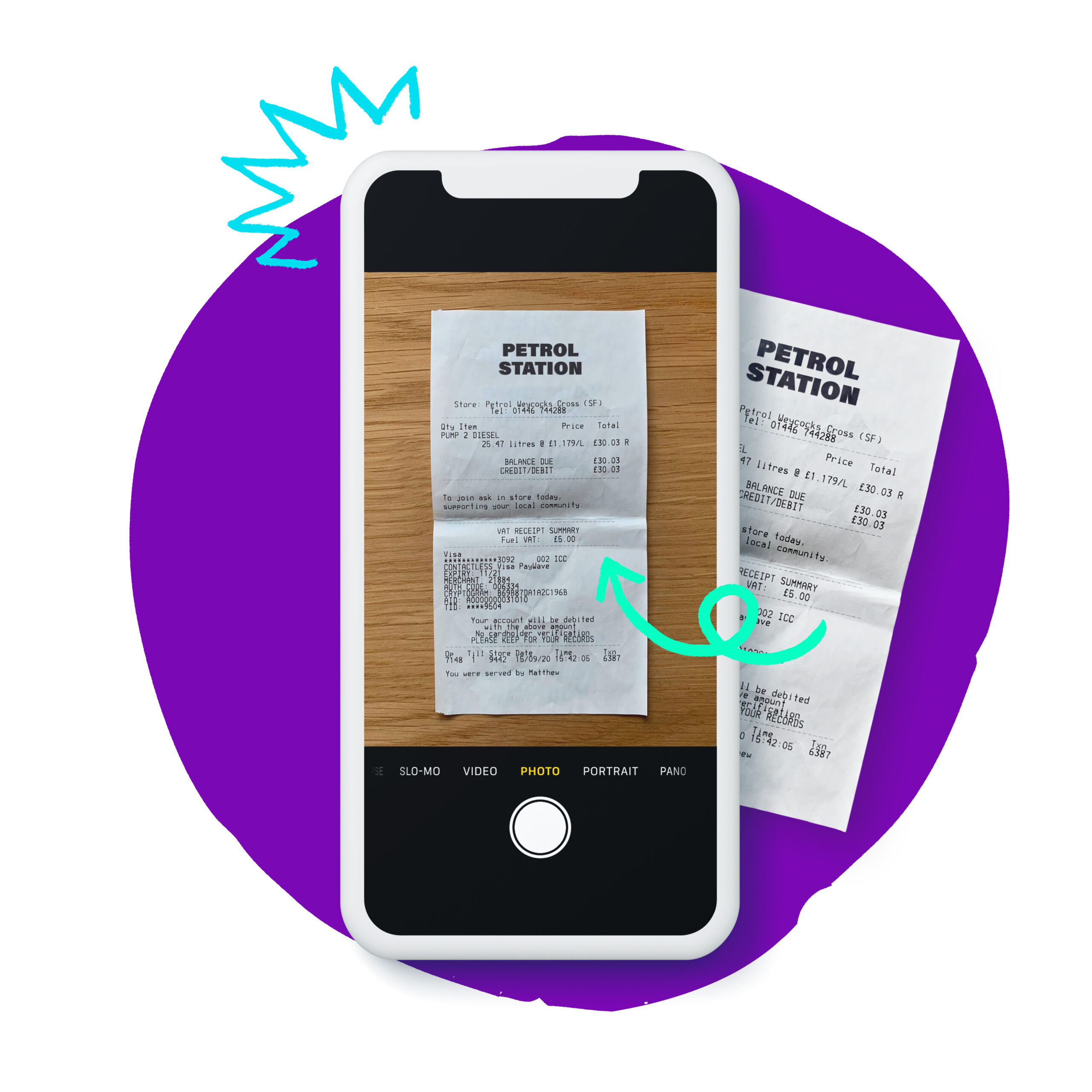

Keeping digital records doesn’t mean you don’t have to keep original paperwork. Quite the opposite, in fact. Original paperwork still needs to be stored as it could be required by HMRC in the event of a tax or VAT investigation. For most businesses, it means keeping paperwork for at least six years, though for many it is a minimum of 10 years. HMRC will accept digital copies of receipts and invoices, so you could scan documents and store them to save on storage space in the office. But who has time for that?

Getting ready for keeping digital records and MTD

Businesses can either submit information through their accountants or independently by using HMRC-approved accounting software.

Something we pride ourselves on at Mazuma is digitising records for our clients. Those who prefer more traditional methods or may be sceptical of a more digital future can send us all of their paperwork. We’ll scan and digitise it for them, saving them a lot of admin hassle and keeping them completely compliant with current and future MTD rules.

If you wish to submit information independently using accounting software, be mindful that the software you use should remove most of the admin burden by default. Remember, if you are transferring data from paperwork into software, you must keep the original documents in case they are required by HMRC at a later date.

If you don’t feel it is removing the admin burden, you should consider switching to a different software provider, or using an accountancy service.

Warning!

Be very careful if you rely on something other than approved software or an accountant. In our experience, many businesses still use Microsoft office software for their VAT accounting work. Although it is possible to be compliant this way, it comes with big risks.

To be compliant with Making Tax Digital, you must ensure that the data those files contain is not only kept for the required statutory period, but that it is stored without any risk of loss or corruption. The risk of Excel spreadsheet formulas or Word documents becoming corrupted, overwritten or deleted entirely is relatively high. Therefore, I would not recommend using Microsoft Office software (or similar) to keep digital records.

Which VAT records do I need to keep digitally?

If you want some further reading on which VAT records must be kept digitally, HMRC’s VAT Notice 700/22(1) explains everything in plenty of detail.

We can save you some time, though, and advise you to move away from any manual system and replace it with a digital version as soon as possible – either by way of HMRC-approved software or by enlisting the services of an accountant – to keep your business compliant with MTD rules.