The benefits of registering as a Limited Company

If you’re a small business owner, you’re likely to come across this question pretty early on. Or you might be a sole trader, now considering registering your business as a limited company. Here’s what you need to know.

What’s the lowdown on sole trader vs. limited company

Operating as a sole trader means you are registered a self-employed person, without the red-tape that goes with running a limited company. You just submit accounts to HMRC, pay tax, and that’s it.

Recent statistics show that sole traders account for over 79% of growth in private sector business in the UK. A popular choice no doubt due its simplicity. The flexibility can help business owners realise their ideal work/life balance too – avoiding additional administration and complexity.

However, as a freelancer or small business, you may not have realised that you can still enjoy many of these benefits as a limited company, while also enjoying some additional benefits.

So, in this article we try to explain the benefits so that you might feel more confident in your decision. We also discuss some FAQ’s and considerations in the hope of clearing up any doubts that might be otherwise holding you back.

Benefits of registering with Companies House

There are two main benefits to enjoy as a result of registering; tax efficiency and reduced personal risk.

Tax efficiency

As a limited company you have the ability to take your income through a combination of salary and dividends. The general consensus is that this could mean that you end up paying less tax on your income, should you register. That has to be worth looking into, right?

How it works…

As a director of a limited company, you can pay yourself a dividend on any profit made. And up to a set amount (which currently stands at £2,000) you don’t pay tax. For amounts that exceed the £2,000 threshold, this there is a (relatively low) tax rate of 7.5%* which applies. So, combined with the basic salary, that’s an annual amount of £13,850 tax free, per director. This article breaks it down particularly well.

Reducing risk

Otherwise known as “limited liability”.

You may or may not be aware that as a sole trader you are personally liable for any debts that you incur. As a limited company, however, that debt would belong to the company and your personal finances wouldn’t normally be affected should things go awry. Since nothing in any business industry is certain, this can be a real benefit to you should you ever need to close.

By being a separate entity you’re not placing your household at the same risk, and past experience shouldn’t hinder any future ventures. Some people prefer the peace of mind that gives them, particularly if they are the main breadwinner of the household. Having that safety net can really reduce the pressure on you and help you enjoy your work more. And, at the end of the day, isn’t that what it’s all about?

Being a limited company also helps others compartmentalise their work so that it feels wholly separate to their personal life. Even if you tend to work from home there can be something healthier about being able to switch off when you need to.

Learn more about limited company costs and finances here.

It’s easier than you think

Registering involves relatively little, so you might be pleasantly surprised. It can also be a swift process so, once you’ve made up your mind, you can turn it around quickly. Usually within a day.

You can register on your own behalf or through an agent (e.g. a bookkeeper or accountant) if you use one. Companies House will require some information from you, but it’s information you should have readily available to you. There’s also a fee of £12. That’s it. An agent may charge you a small fee for registering on your behalf but it will be relative to the amount of time and effort they spend doing it, which should also be minimal.

There are some further considerations to take into account.

- Dividend threshold/tax rates on dividends

- Will you need an accountant?

- What insurance is necessary?

Dividend threshold

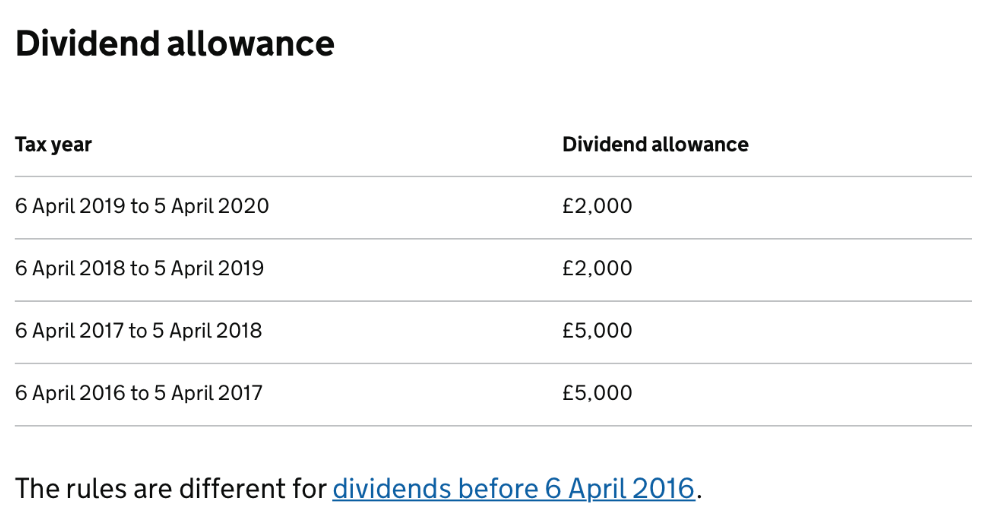

Being on top of changes with HMRC is essential. For example, the tax threshold for dividends used to be £5,000 (before they reduced it to £2,000) as recently as the 2017/2018 financial year, but it changed. Changes in the political and economic landscape are unavoidable and will affect how to proceed with future tax dealings and likewise what applies to backdated finances.

Pictured above: Dividend allowance. (Source www.gov.uk)

Will you need an accountant?

Not necessarily – but it will save you hassle.

You might be wondering whether, as a limited company, you’d suddenly need to start using an accountant. For things like compliance, submitting your tax return and end of year it would probably be a good idea. They will also be able to warn you about changes to legislation that would affect you.

If you’re already using an accountant for a sole trader business, you may worry whether there will be a significant hike in fees. This may be true, but it’s always worth getting a comparison quote from a company like Mazuma who have streamlined the process for business owners, meaning you can get a really good service for a small business friendly price.

Don’t be put off by fees until you’ve had some quotes. The cost could be negligible compared with the tax savings you could be making by becoming a limited company.

Insurance

Depending on your business, your insurance requirements may not necessarily change. That said, now is as good a time as any, to check (irrespective of your employment set up) whether you’re insured adequately. The minimum requirements are generally public liability insurance and professional indemnity insurance

If you decided to register as a limited company that would only really change the minimum requirements if you start employing people or if you’re making tangible products rather than trading services. Then you might want to consider employer liability insurance and product liability cover. Read more on that, and other types of insurances, here.

What next?

From our point of view, the limited company route is always, at very least, worth some serious consideration. As you’ve undoubtedly seen for yourself, running your own business is not for the faint hearted and, despite the many joys of working for yourself, it sometimes can be incredibly hard work.

So all we’re saying is check out that you’re not missing out – feel free to get in touch for a quote to see how much you could be saving – on tax and accountancy fees.